쇼핑몰 | Transferring Your IRA To Gold: A Comprehensive Information

페이지 정보

작성자 Oliva 작성일25-08-06 18:35 조회5회 댓글0건관련링크

본문

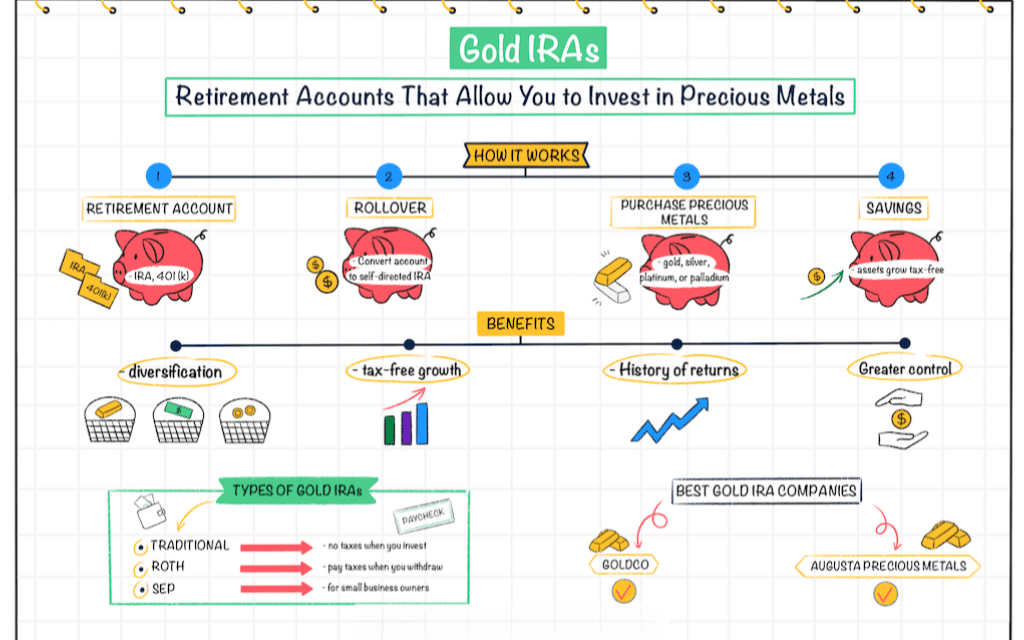

In recent years, the concept of transferring an individual Retirement Account (IRA) into gold has gained important traction amongst traders seeking to diversify their retirement portfolios. This technique not only gives a hedge in opposition to inflation and economic instability but in addition gives the potential for long-term capital appreciation. This text delves into the intricacies of transferring an IRA to gold, exploring the benefits, the process, and concerns to bear in mind.

Understanding the basics of IRAs and Gold Funding

An IRA is a tax-advantaged savings account designed to encourage people to avoid wasting for retirement. Traditional IRAs enable for pre-tax contributions, while Roth IRAs make the most of publish-tax contributions, providing tax-free withdrawals in retirement. Gold, then again, has been a retailer of worth for centuries, typically seen as a secure haven during occasions of financial uncertainty. By transferring an IRA to gold, traders can gain publicity to this treasured steel while enjoying the tax benefits associated with retirement accounts.

The benefits of Transferring an IRA to Gold

- Inflation Hedge: Gold has traditionally maintained its value during inflationary intervals. As the buying energy of fiat currencies declines, gold usually appreciates, making it an efficient hedge against inflation.

- Diversification: Incorporating gold into an funding portfolio can cut back total threat. Gold typically has a low correlation with conventional asset classes such as stocks and bonds, meaning that when these belongings decline, gold could hold its value or even improve.

- Financial Uncertainty: During occasions of economic turmoil, geopolitical tensions, or financial crises, gold often serves as a safe haven. Traders might flock to gold when confidence within the financial system wavers, driving up its value.

- Tangible Asset: Not like stocks or bonds, gold is a bodily asset that can be held in hand. This tangibility can provide a way of security for investors who are cautious of digital or paper property.

The Strategy of Transferring an IRA to Gold

Transferring an IRA to gold involves a number of steps, making certain compliance with IRS rules and facilitating a smooth transition.

- Select the precise Kind of Gold IRA: There are two main varieties of gold IRAs: Traditional and Roth. Your selection will rely on your present tax situation and retirement objectives. Traditional Gold IRAs contain pre-tax contributions, while Roth Gold IRAs allow for tax-free withdrawals in retirement.

- Choose a Custodian: The IRS requires that IRAs be held by a certified custodian. When transferring to a gold IRA, it is crucial to choose a custodian skilled in dealing with treasured metals. They will handle the paperwork, guarantee compliance, and facilitate the acquisition of gold.

- Open a Gold IRA Account: After getting chosen a custodian, you might want to open a gold IRA account. In case you have any kind of inquiries regarding in which along with the way to work with affordable investment in retirement gold-backed iras, you can e-mail us from our website. This process typically entails filling out an utility and providing essential documentation.

- Fund Your Gold IRA: You'll be able to fund your gold IRA by means of a rollover from an present IRA or by making a direct contribution. If rolling over, ensure that you just observe IRS tips to avoid tax penalties. A direct rollover, where funds are transferred straight from one custodian to another, is commonly the preferred methodology.

- Buy Gold: After funding your account, you possibly can instruct your custodian to purchase gold on your behalf. It is crucial to ensure that the gold meets IRS standards for purity and kind. Acceptable forms of gold include American Gold Eagles, Canadian Gold Maple Leafs, and gold bars that meet particular purity requirements.

- Storage: The IRS mandates that gold held in an IRA have to be saved in an authorized depository. Your custodian can show you how to find a secure location for your gold. It's essential to make sure that the storage facility is insured and compliant with IRS regulations.

Considerations When Transferring an IRA to Gold

Whereas transferring an IRA to gold may be beneficial, there are a number of issues to remember:

- Charges: Gold IRAs often include numerous fees, together with setup charges, annual maintenance charges, and storage fees. It is essential to understand the associated fee structure earlier than proceeding.

- Market Volatility: The value of gold can be risky, influenced by components corresponding to international financial conditions, interest rates, and currency fluctuations. Investors needs to be ready for worth fluctuations and consider their risk tolerance.

- Limited Development Potential: Whereas gold can serve as a hedge and store of value, it doesn't generate revenue like stocks or bonds. Investors searching for capital appreciation ought to consider this limitation.

- Regulatory Compliance: It's important to ensure that each one transactions comply with IRS rules to keep away from penalties. Working with a knowledgeable custodian will help navigate these complexities.

Conclusion

Transferring an IRA to gold is usually a strategic transfer for traders seeking to diversify their retirement portfolios and protect their wealth against financial uncertainty. By understanding the benefits, the method, and the considerations involved, people can make informed decisions about incorporating gold into their retirement technique. As with any investment, thorough research and consultation with financial advisors are really helpful to align this strategy with general monetary goals. Because the economic landscape continues to evolve, gold remains a timeless asset that may present security and affordable investment in retirement gold-backed iras stability in an investor's portfolio.

댓글목록

등록된 댓글이 없습니다.