블로그 | Understanding Gold IRA: A Complete Guide

페이지 정보

작성자 Danielle 작성일25-07-12 04:14 조회9회 댓글0건관련링크

본문

On the planet of investment, gold has long been thought-about a safe haven asset. Its intrinsic value and historic significance have made it a popular alternative for investors trying to protect and develop their wealth. One modern approach to put money into gold is through a Gold Particular person Retirement Account (IRA). This text will explore what a Gold IRA is, how it really works, its advantages and drawbacks, and the steps involved in setting one up.

What's a Gold IRA?

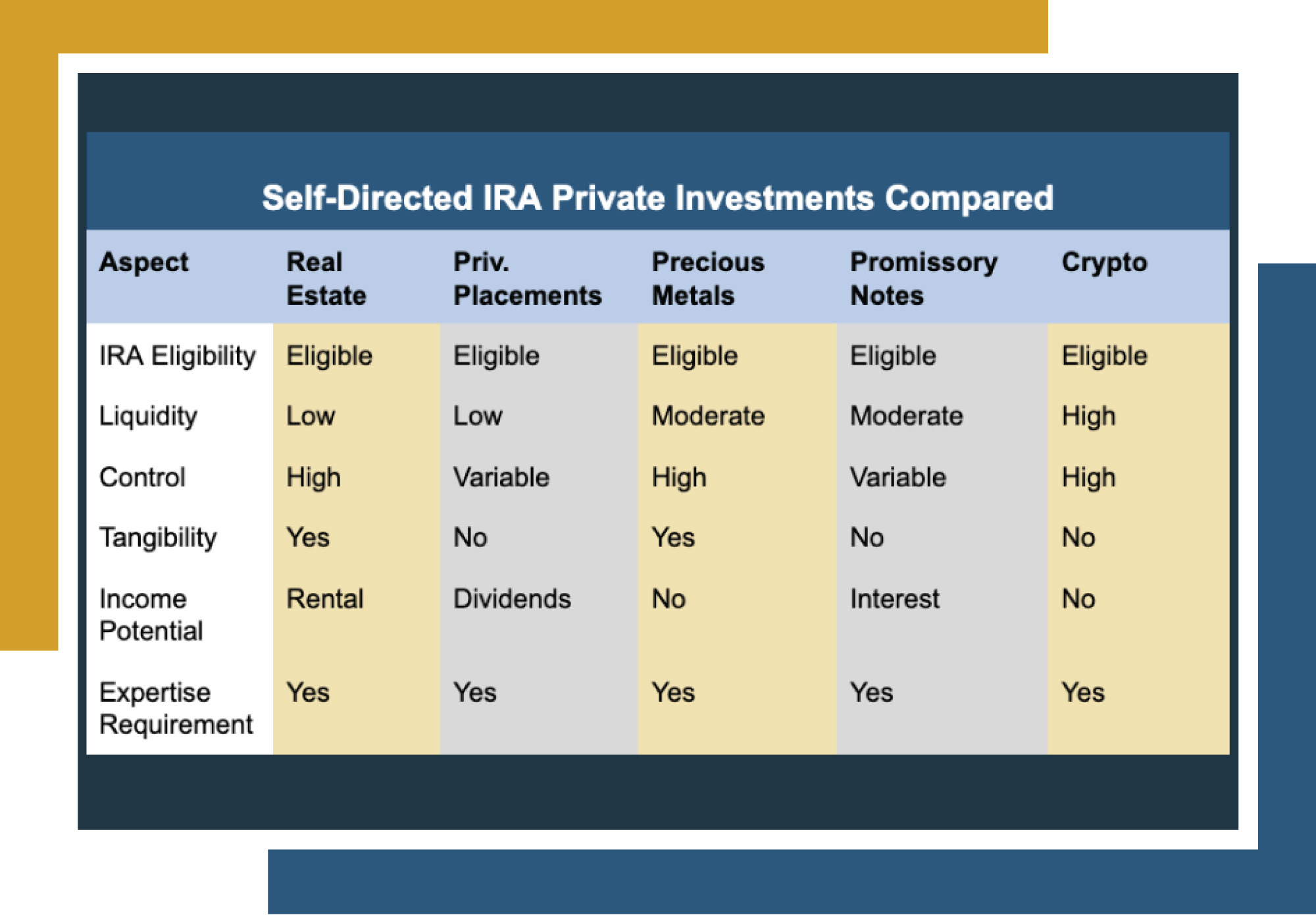

A Gold IRA is a type of self-directed Individual Retirement Account that allows traders to carry bodily gold, as well as different treasured metals, as a part of their retirement portfolio. In contrast to traditional IRAs that sometimes hold stocks, bonds, or mutual funds, a Gold IRA gives the unique advantage of diversifying investments by including tangible property.

How Does a Gold IRA Work?

A Gold IRA operates equally to a conventional IRA, but with a couple of key variations. Here’s how it works:

- Establishing the Account: To arrange a Gold IRA, you want to decide on a custodian who makes a speciality of valuable metals. This custodian will provide help to navigate the laws and affordable firms for ira gold rollover ensure compliance with IRS guidelines relating to the storage and handling of treasured metals.

- Funding the Account: You can fund your Gold IRA via various methods, including a rollover from an existing retirement account (like a 401(k) or traditional IRA) or by making direct contributions. It’s essential to follow IRS guidelines when rolling over funds to keep away from penalties.

- Buying Gold: Once your account is funded, you may purchase eligible gold and other treasured metals. The IRS has particular requirements concerning the types of metals that may be held in a Gold IRA. For instance, the gold should be at least 99. If you treasured this article so you would like to be given more info pertaining to affordable firms for ira gold rollover please visit the web-site. 5% pure and must be produced by an permitted refiner or producer.

- Storage: After buying gold, the bodily assets must be stored in an IRS-accepted depository. You can not keep the gold at house or in a personal safe, as this might violate IRS rules.

- Withdrawals: Whenever you attain retirement age, you can start taking distributions from your Gold IRA. You could select to take physical possession of the gold or convert it into cash. Needless to say distributions are subject to taxes and penalties if taken earlier than age 59½.

Advantages of a Gold IRA

Investing in a Gold IRA provides a number of advantages:

- Hedge Towards Inflation: Gold has traditionally maintained its value during intervals of inflation, making it an efficient hedge against rising costs. As the value of paper currency declines, the worth of gold typically increases.

- Diversification: Together with gold in your retirement portfolio can present diversification, decreasing general risk. Gold typically moves independently of stocks and bonds, which may also help stabilize your funding returns.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that you may hold. This tangibility can present peace of mind, particularly during economic uncertainty.

- Tax Benefits: Gold IRAs provide the same tax benefits as conventional IRAs. Contributions may be tax-deductible, and the growth of your investment is tax-deferred until withdrawal.

- Potential for Growth: Gold has traditionally appreciated in value over the long run, offering the potential for important returns on investment.

Drawbacks of a Gold IRA

While there are many benefits to a Gold IRA, there are additionally some drawbacks to consider:

- Fees and Prices: affordable Firms for ira gold rollover Setting up and maintaining a Gold IRA will be costlier than a conventional IRA. Custodial charges, storage charges, and transaction fees can add up, impacting your overall returns.

- Restricted Funding Options: A Gold IRA is proscribed to precious metals, which can not provide the identical degree of diversification as a standard IRA that includes a broader range of investment options.

- Market Volatility: Whereas gold is often thought-about a protected haven, it's not immune to market fluctuations. The price of gold can be volatile, and traders may experience important worth swings.

- Regulatory Compliance: Gold IRAs are subject to strict IRS laws, and failure to comply can result in penalties or disqualification of the account.

- No Cash Move: In contrast to stocks that will pay dividends, gold does not generate revenue. Because of this buyers relying solely on a Gold IRA for retirement earnings may need to promote their gold to entry cash.

Steps to Arrange a Gold IRA

Setting up a Gold IRA includes several steps:

- Analysis and Select a Custodian: Look for a good custodian who specializes in Gold IRAs. Learn opinions, examine fees, and ensure they're IRS-accepted.

- Open Your Account: Complete the necessary paperwork to open your Gold IRA. Your custodian will information you thru this process.

- Fund Your Account: Resolve the way you need to fund your Gold IRA, whether or not through a rollover or direct contributions. Ensure compliance with IRS laws.

- Choose Your Treasured Metals: Work together with your custodian to decide on eligible gold and different precious metals that align along with your investment technique.

- Buy and Store Your Gold: As soon as you’ve chosen your metals, your custodian will facilitate the purchase and arrange for storage in an IRS-accepted depository.

- Monitor Your Funding: Repeatedly assessment your Gold IRA to ensure it aligns along with your retirement objectives and make changes as vital.

Conclusion

A Gold IRA is usually a beneficial addition to your retirement portfolio, offering diversification, protection against inflation, and the enchantment of tangible property. However, it’s important to weigh the advantages against the potential drawbacks and costs. If you’re contemplating a Gold IRA, take the time to research and seek the advice of with monetary advisors to ensure it aligns along with your long-term financial objectives. With careful planning and informed determination-making, a Gold IRA can assist you secure your monetary future in retirement.

댓글목록

등록된 댓글이 없습니다.