홈페이지 | Complete Examine Report On Gold IRA Reviews

페이지 정보

작성자 Kerri 작성일25-07-11 07:22 조회16회 댓글0건관련링크

본문

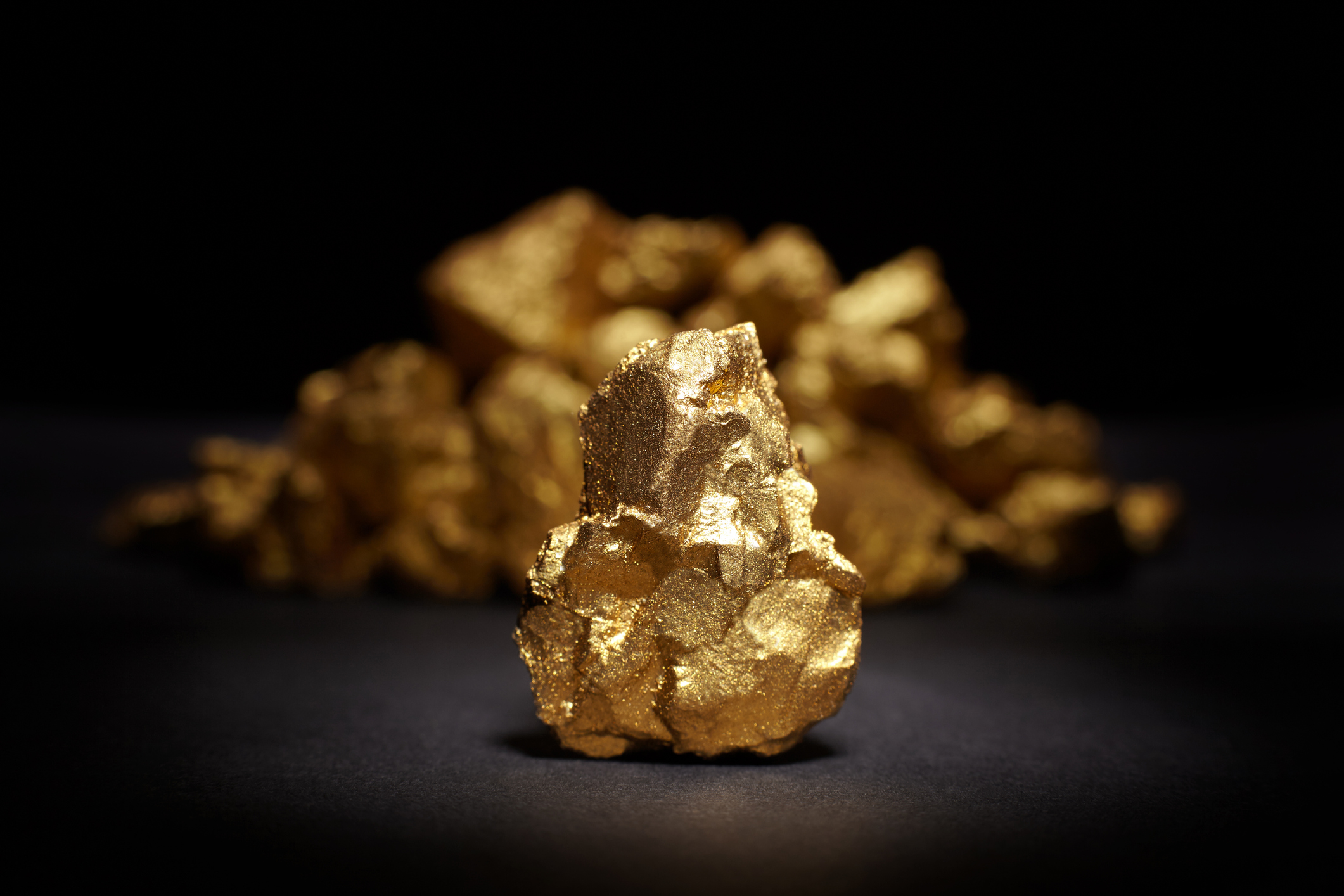

The idea of a Gold Individual Retirement Account (IRA) has gained significant traction lately as buyers search to diversify their portfolios and safeguard their retirement financial savings towards economic uncertainties. This report delves into the varied elements of Gold IRAs, including their structure, benefits, risks, and an analysis of buyer evaluations to provide a complete understanding of their viability as an investment option.

Understanding Gold IRAs

A Gold IRA is a sort of self-directed particular person retirement account that allows traders to hold bodily gold, silver, platinum, and palladium of their retirement portfolio. Unlike traditional IRAs, which usually hold paper property equivalent to stocks and bonds, Gold IRAs provide the benefit of tangible assets. The interior Revenue Service (IRS) regulates these accounts, requiring that precious metals meet specific purity requirements and are saved in accepted depositories.

Benefits of Gold IRAs

- Hedge In opposition to Inflation: Gold has historically been seen as a safe haven during periods of inflation and economic instability. Traders often flip to gold to preserve their buying energy when fiat currencies lose worth.

- Portfolio Diversification: Together with gold in an investment portfolio can reduce overall risk. Gold usually behaves in a different way than stocks and bonds, providing a buffer throughout market downturns.

- Tax Advantages: Like conventional IRAs, Gold IRAs supply tax-deferred growth. Investors do not pay taxes on positive aspects till they withdraw funds in retirement, doubtlessly allowing for vital development over time.

- Tangible Asset: Gold is a bodily asset that buyers can hold, providing a sense of safety that digital belongings can not supply.

Dangers of Gold IRAs

- Market Volatility: Whereas gold is often seen as a safe funding, its price might be unstable. Buyers might expertise significant fluctuations in worth, which can influence their retirement financial savings.

- Storage and Insurance coverage Costs: Physical gold must be saved in a secure facility, and investors may incur further prices for storage and insurance. These costs can eat into the general returns of the funding.

- Restricted Development Potential: In contrast to stocks, gold doesn't produce dividends or curiosity. Traders rely solely on price appreciation for returns, which is probably not as sturdy as other funding options.

- Regulatory Issues: Traders should navigate IRS laws relating to Gold IRAs, including the requirement that certain types of gold and different treasured metals be held in approved depositories.

Buyer Opinions and Experiences

To gauge the effectiveness and reliability of Gold IRAs, it is crucial to research customer evaluations and experiences. This part summarizes findings from numerous evaluation platforms, highlighting frequent themes and sentiments expressed by traders.

Positive Reviews

- Security and Peace of Mind: Many buyers specific satisfaction with the safety that a Gold IRA provides. They admire the tangible nature of gold and feel more safe knowing their wealth isn't solely tied to the inventory market.

- Customer support: Several evaluation platforms highlight constructive experiences with customer support representatives from Gold IRA companies. Investors commend responsive and knowledgeable staff who information them through the setup course of and answer their questions.

- Instructional Sources: Many corporations present educational supplies that help buyers perceive the benefits and risks of Gold IRAs. If you loved this article and you simply would like to be given more info with regards to gold ira reviews i implore you to visit our web site. Customers typically recognize these resources, which empower them to make informed choices.

- Diversification Advantages: Traders frequently point out the diversification advantages of adding gold to their retirement portfolios. They report feeling extra confident about their financial future with a balanced method to investing.

Destructive Evaluations

- Excessive Fees: A typical complaint amongst buyers is the excessive fees associated with Gold IRAs. Some customers feel that the costs for storage, insurance coverage, and management are extreme, Gold IRA reviews which might diminish general returns.

- Complicated Setup Process: Some opinions point out that the strategy of organising a Gold IRA might be advanced and time-consuming. Investors report frustration with paperwork and regulatory necessities, suggesting that firms could enhance their onboarding processes.

- Market Risk: Whereas many traders are aware of the market risks associated with gold, some categorical disappointment when the value of their funding does not carry out as expected. This underscores the importance of setting practical expectations relating to returns.

- Restricted Funding Options: Some customers wish for more flexibility in their Gold IRA investments, expressing a want to incorporate a broader vary of treasured metals or alternative property.

Conclusion

Gold IRAs present a novel opportunity for buyers looking for to diversify their retirement portfolios and hedge towards economic uncertainties. While they provide several benefits, together with tax advantages and Gold IRA reviews the security of tangible property, potential traders should additionally bear in mind of the related dangers and costs.

Buyer reviews provide beneficial insights into the overall satisfaction of traders with Gold IRAs, revealing each optimistic experiences and areas for enchancment. As with any funding, conducting thorough analysis and understanding one’s monetary targets is crucial before committing to a Gold IRA.

In abstract, Gold IRAs can be a beneficial component of a diversified retirement technique, provided that investors strategy them with a clear understanding of each the benefits and challenges they current. As financial circumstances continue to evolve, the position of Gold IRAs in retirement planning will likely remain a topic of interest for traders searching for stability and development in their portfolios.

댓글목록

등록된 댓글이 없습니다.